When you look ahead to next year, will your growth come from selling more to your existing customers or finding new customers for your existing products and services?

When you look ahead to next year, will your growth come from selling more to your existing customers or finding new customers for your existing products and services?

The answer may have a profound impact on the value of your business.

Take a look at the research coming from a recent analysis of owners who completed their Sellability Score questionnaire. We looked at 5,364 businesses and found that the average company that had received an overture from an acquirer was offered 3.5 times their pre-tax profit. When we isolated just the businesses that had a historical growth rate of 20 per cent or greater, the multiple offered improved to 4.3 times pre-tax profit, or about 20 per cent more than their slower growth counterparts.

However, the real bump in multiple came when we isolated just those companies that claim to have a unique product or service for which they have a virtual monopoly. The niche companies enjoyed average offers of 5.4 times pre-tax profit, or roughly 50 per cent more than the average companies, and fully 20 per cent more than the fastest growth companies.

Nurture Your Niche

Chasing “bad” turnover by offering a wide array of products and services is common among growth companies. The easiest way to grow is to sell more things to your existing customers, so you just keep adding adjacent product and service lines. But when a strategic acquirer buys your business, they are buying something they cannot easily replicate on their own.

A large company will place less value on the turnover derived from products and services that you have in common. They will argue that their economies of scale put them in a better position to sell the things that you both offer today.

Likewise, they will pay the largest premium to get access to a new product or service they can sell to their customers. Big, mature companies have customers and systems, but they sometimes lack innovation; and many choose a strategy of acquisition as a way to buy their innovation.

Focusing on your niche is one of many areas where the long-term value of your business is at odds with short-term profit. For example, if you wanted to maximize your short-term profit, you might avoid investing in new technology or hiring a head of sales, arguing that both investments would hinder short-term profit. The truly valuable company finds a way to deliver profit in the short term while simultaneously focusing their strategy on what drives up the value of the business.

You can get your own Sellability Score, and see how you compare on the eight key drivers of sellability, by taking our 13-minute survey here : https://www.businesscompanion.com.au/sellability-score/

The most powerful metrics in any business are ratios that express your performance on metric A as it relates to metric B. For example, knowing what your turnover was last year is interesting; but knowing what your turnover per employee was will give you a sense of how efficient your business is at leveraging your investment in people.

The most powerful metrics in any business are ratios that express your performance on metric A as it relates to metric B. For example, knowing what your turnover was last year is interesting; but knowing what your turnover per employee was will give you a sense of how efficient your business is at leveraging your investment in people.

The ultimate test of your business can be found in a simple question: would someone want to buy your company?

The ultimate test of your business can be found in a simple question: would someone want to buy your company? knowledge to your employees, so that they can deliver the goods. However it can be difficult to condense years of school and on-the-job learning into a few weeks of employee training. The more specialised your knowledge, the harder it is to hand over work to juniors.

knowledge to your employees, so that they can deliver the goods. However it can be difficult to condense years of school and on-the-job learning into a few weeks of employee training. The more specialised your knowledge, the harder it is to hand over work to juniors. arren Buffett famously invests in businesses that have what he calls a protective ‘moat’ around them – one that inoculates them from competition and allows them to control their pricing.

arren Buffett famously invests in businesses that have what he calls a protective ‘moat’ around them – one that inoculates them from competition and allows them to control their pricing.

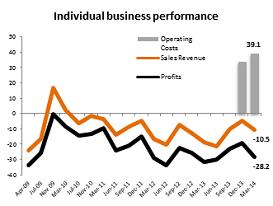

Businesses became more negative about their own performance, compared with December 2013.

Businesses became more negative about their own performance, compared with December 2013. SME’s should consider the structure of their business, with almost a 20% difference in individual tax rates compared to a company. Interesting article by

SME’s should consider the structure of their business, with almost a 20% difference in individual tax rates compared to a company. Interesting article by  ke a look at the research coming from a recent analysis of owners who completed their Sellability Score questionnaire. We looked at 5,364 businesses and found that the average company that had received an overture from an acquirer was offered 3.5 times their pre-tax profit. When we isolated just the businesses that had a historical growth rate of 20 per cent or greater, the multiple offered improved to 4.3 times pre-tax profit, or about 20 per cent more than their slower growth counterparts.

ke a look at the research coming from a recent analysis of owners who completed their Sellability Score questionnaire. We looked at 5,364 businesses and found that the average company that had received an overture from an acquirer was offered 3.5 times their pre-tax profit. When we isolated just the businesses that had a historical growth rate of 20 per cent or greater, the multiple offered improved to 4.3 times pre-tax profit, or about 20 per cent more than their slower growth counterparts.